Why I’m betting big on Web 3.0

Web 3.0 ≡ version 3 of the internet.

The simplest way to identify the difference between Web 1. 2. 3 is:

- Read

- Read / Write

- Read / Write / Own

Like many people who first dabble into blockchain and crypto there is an invisible event horizon you will inevitably surpass beyond a particular point

Back in March 2020 I danced around this event horizon. Dabbling into Bitcoin at £4k, Ethereum at £98 and I became involved with a project called Decentraland

Truthfully, It was one of the smartest stupid things I have ever done

I knew next-to-nothing at the time. Even now, I write this from a position of inept knowledge of the technical intricacies surrounding DeFi platforms, DAO’s and tokenomics

However, over the last 18 months of working with some extremely talented people, I have since eclipsed that event horizon. I am now firmly of the belief that Web 3.0 is enabling the largest and fastest distribution of wealth in all recorded history

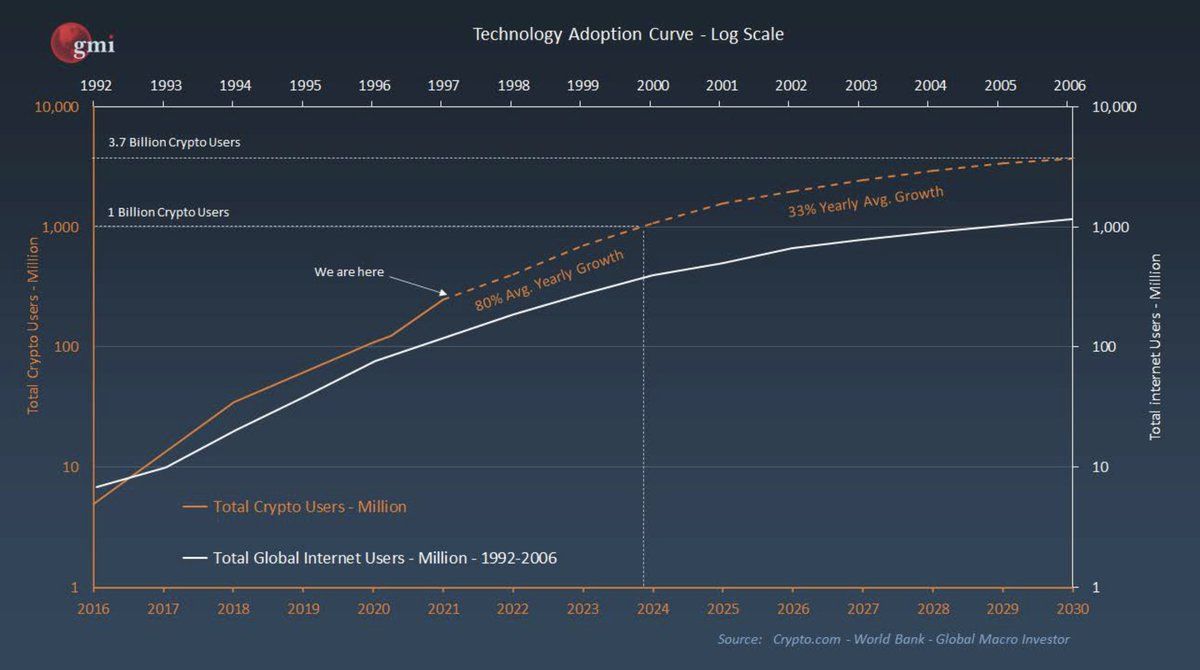

There was a 63% year-on-year adoption rate of the internet in the late 90’s and at the point of writing this post there is a 113% year-on-year adoption rate of cryptocurrencies

GMI outlines how the adoption rate of crypto currencies mirrors the adoption rate of internet users from the late 90’s

Unlike other historic tools of wealth distribution such as railroads, phones, computers and even the internet as we currently understand it - all of these things accrued to large multinational corporations

The difference with Web3 is it’s accruing to tokens which anybody with an internet connection can participate in

As the network effect amplifies, and more people adopt this revolutionary technology, you can begin to see Metcalfe’s law defining the value of these emerging communication networks proportionally to the square of the number of users

When considering the upward trend in adoption rates, it’s quite obvious to me that we are about to head into a supersonic growth period of an entirely new technology and asset class over the next number of years

Dapps (Decentralised Apps)

The internet as we currently use it is siloed by organisations where the data is controlled and monopolised by technology giants

The reason why the opportunities and wealth generation from Web3 is going to be so non-linear and so fast is because Web3 flips applications from being closed, to “open” - where the contributors (like you, and me) will own the platform, and users will own and be in control of their data with digital private keys

On the blockchain, digital private keys enable digital private property

Consider a future where we won’t need Spotify or Netflix to determine who owns what private property and hold it with their database entries and their lawyers

Instead, we can each own a piece of the internet without the middlemen through mechanisms called smart contracts

A lot of people I know (and respect) typically dismiss the notion of digital scarcity. The mistake these people often make is that they haven’t yet seen how digital scarcity can easily map to real world scarcity

Smart contracts are the backbone of blockchain networks like Ethereum

For me, Ethereum is probably the most exciting project in the space. Simply due to it’s size, practicality and future vision / planned updates

My belief is that almost everything which can be digitally and physically owned will eventually - in the not too distant future - sit on a blockchain network somewhere secured by smart contracts and governed by decentralised autonomous organisation’s (DAO’s)

ENS

One of the most successful examples of a DAO currently utilising smart contracts on the Ethereum blockchain is the Ethereum Name Service (ENS) - which essentially allows people to create digital identities on the blockchain network

At the moment, ENS’s job is to map human-readable names like ‘name.eth’ to machine-readable identifiers such as Ethereum addresses

When you consider the centralisation of how typical domains are managed, you begin to understand why DAO’s are so powerful

For example; there are currently 200M active websites in the world right now and one U.S. company - VeriSign (VRSN) - maintains 172M of them. VeriSign has a long-term, no-bid contract with an unelected international body (ICANN), which has been repeatedly renewed at the request of the U.S. government, who considers the service crucial infrastructure

VeriSign is entirely centralised. ENS is entirely decentralised. You can read more about it, here.

Uniswap

Uniswap is another project worth noting which is referred to as a “DeFi” (decentralised finance) exchange

DeFi exchange platforms like Uniswap have a liquidity pool where anyone can provide liquidity of a particular token whilst being rewarded for being a contributor

The entire network is organised by smart contracts tied to our own individual private keys. It mimics a traditional centralised exchange whilst removing the middlemen of bankers, lawyers, forex traders whilst being faster, more efficient, cheaper and has no central authority - the permissionless smart contracts circumvents the need for a centralised body

Acknowledgment:

I will preface this with the acknowledgment this is very early technology. I am very acutely aware of the problems associated with these platforms. I understand the practical uses of such technology are particularly niche (right now). However, like with all new things, this will change and evolve over time

The risk associated to being on the frontier of Web 3.0 is high, and rightly so; having the balls to bet big on a search engine in the late 90’s would have raised a few eye brows from from folk investing into General Electric

Blue sky thinking and future vision

Back in 2018 I read a book called “The Birth of Plenty” which completely changed the way I invested in countries around the world. This book made me understand the importance of private property and the very idea of ownership backed by the rule of law

As some one who is now a resident and actively invested in multiple countries across 3 continents - I have some skin in the game when it comes to currency devaluation and the rise of Bitcoin as a legitimate alternative to the Turkish Lira, Venezuelan Bolívar, South African Rand and many (many) more.

Before all of this, private property and the rule of law had been things I had taken for granted for my entire life. This was until I started seeing, experiencing and understanding how different systems operate around the world for extended periods of time

I have been lucky to have once called the UK my home of residence - despite it’s shortcomings, we have deeds for private property. Certificates for university degree’s. Legally binding contracts for conducting business - all of which, are supported by a well established legal system and a legal tender which has been around for 1,200 years

The UK system is what’s commonly referred to as: “Lindy”

However, many people living in such countries with Lindy systems often fail to understand that the same can’t be said for a promising selection of emerging economies around the world

Smart contracts and crypto currencies are becoming a truly monumental force in emerging markets. Especially in those places where private ownership backed by the rule of law doesn’t adequately exist, and local currency devaluation is rampant due to a mismanagement of (often dubious) centralised power

By having open, transparent systems governing and solving the double coincidence of wants in both tangible and intangible goods and services is something I’m a strong advocate for

This gives you a subtle glimpse of where I can see this new world moving, and how much of a fundamental impact it will have on the world as we currently understand it.

I’ll leave you with this, a video of David Bowie in 1999...

See you on the other side 🤘

darcey.eth